Covered Call

A Covered Call is the most basic of income strategies, yet it is also highly effective and can be used by novices and experts alike.

The concept is that in owning the stock, you then sell and Out of the Money call option on a monthly basis as a means of collecting premium while you own the stock.

Steps to Trading a Covered Call

- Buy (or own) the stock.

- Sell calls one or to strike prices out of the money (OTM).

If the stock is purchased simultaneously with writing the call contract, the strategy is commonly referred to as a “buy-write”.

Generally, only sell the calls on a monthly basis. In this way, you will capture more premiums over several months, provided you are not exercised. Selling premium every month will net you more over a period of time than selling premium a long way out. Remember that whenever you are selling options premium, time decay works in your favor. Time decay is at its fastest rate in the last 20 trading days, so when you sell option premiums, it is best to sell them with a month left, and do it again the following month.

Remember that your maxim gain is capped when the stock reaches the level of the call’s strike price.

If trading U.S. stocks and options, you will be required to buy or be long 100 shares for every options contract that you sell.

Entry – Some traders prefer to select stocks between $10 and $50, considering that above $50 it would be expensive to buy the stock. Ultimately it’s what you feel comfortable with.

Try to ensure that the trend is upward or rangebound and identify a clear area of support.

Exit – Manage your position according to the rules defined in your Trading Plan.

If the stock closes above the strike at expiration, you will be exercised. You will deliver the stock at the strike price, whilst

If the stock remains below the strike but above your stop loss, let the call expire

If the stock falls below your stop loss, then either sell the stock (covering short call first) or sell the stock and let the call decay (if you’re approved to hold options naked).

Covered Call Set Up

Outlook:

With a Covered Call, our outlook is neutral to bullish. You expect a steady rise.

Rationale:

To buy (or own) a stock for the medium or long term with the aim of capturing monthly income by selling calls every month. This is like collecting rent for holding the stock and will have the effect of lowering your cost basis of holding the stock.

If the stock rises, your short call may be exercised, in which case you will make some profit. If you are exercised, then your shares will be sold.

If the stock falls, your sold call will expire

Net Position:

This is a net debit transaction because you are paying for the stock and only taking in a small premium for the sold call options. you can increase your yield by purchasing the stock on margin, thereby doubling your yield if you use 50% margin.

Your maximum risk is the price you paid for the stock less the premium you received for the call.

Effect of Time Decay:

Time decay is helpful to your trade here because it should erode the value of the call you sold. Provided that the stock is trading below the short strike at expiration, you will be able to retain the entire option premium for the trade that will reduce your original cost of buying the shares.

Appropriate Time Period to Trade:

Sell the calls on a monthly basis.

Selecting the Stock:

Choose from stocks with adequate liquidity, preferably over 500,000 average daily volume.

Select a stock price range you feel comfortable with. Ultimately the direction of the stock is more important.

Try to ensure that the trend is upward or rangebound and identify a clear area of support.

Selecting the Option:

Choose options with adequate liquidity. Open interest should be at least 100 contracts. You also want to make sure that bid-ask spread is fairly narrow.

Strike – look for either the ATM or just OTM strike above the current stock. If you’re bullish, then choose a higher strike; if neutral then choose the ATM strike.

Expiration – look at either of the next two expirations and compare monthly yields. Look for over 3% monthly initial cash yield.

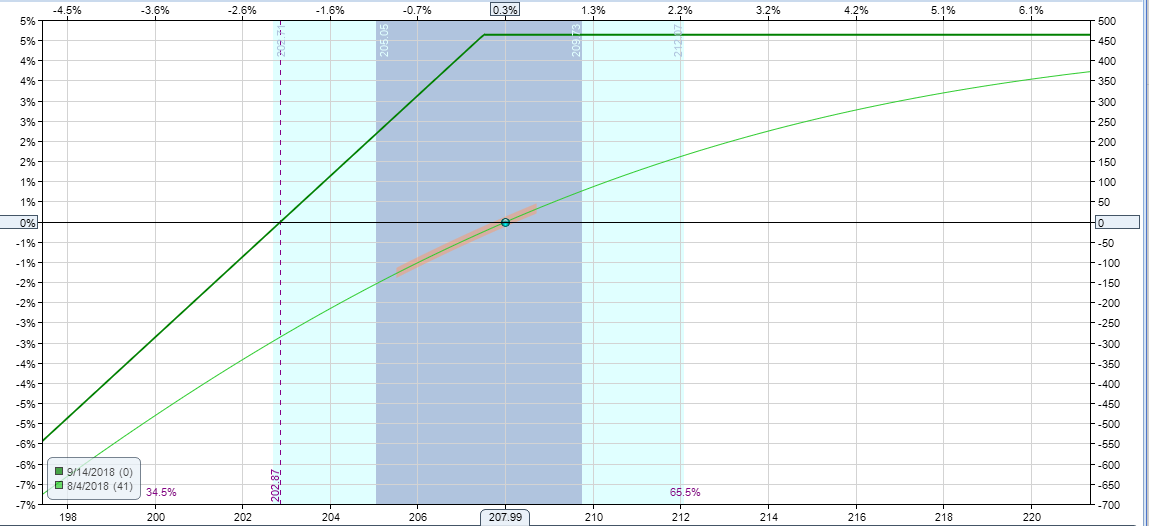

Risk Profile

Maximum Risk –

Maximum Reward – Call strike minus stock price paid plus call premium.

Breakeven – Stock price paid minus call premium collected.

Trade Example

NIKE (NKE) is trading at $78.75

Buy stock at 78.75

Sell September 77.5 strike call for $2.85

Cost Basis: 78.75 – 2.85 = 75.90 ($7,590 for 100 shares)

Maximum Risk: 100% of the investment. Even though selling a call against long position reduced cost basis, if the stock goes to 0 then the entire investment is at risk.

Max Reward: 2.85 + 77.5 – 78.75 = 1.60

Breakeven: 78.75 – 2.85 = 75.90